44 us treasury bonds coupon rate

30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of May 04, 2022 is 3.01%. Show Recessions. US Treasury Bonds Rates - Yahoo Finance US Treasury Bonds Rates. Symbol. Name Last Price Change % Change 52 Week Range Day Chart ^IRX. 13 Week Treasury Bill: 0.9050 +0.0220 +2.49% ^FVX. Treasury Yield 5 Years: 2.7820-0.0970-3.37% ^TNX.

A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

:max_bytes(150000):strip_icc()/shutterstock_727670.bearer.bond.cropped-5bfc3069c9e77c005180aeaa.jpg)

Us treasury bonds coupon rate

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. Individual - Series I Savings Bonds - TreasuryDirect Rates & Terms. I bonds have an annual interest rate derived from a fixed rate and a semiannual inflation rate. Interest, if any, is added to the bond monthly and is paid when you cash the bond. I bonds are sold at face value; i.e., you pay $50 for a $50 bond. More about I bond rates; Redemption Information. Minimum term of ownership: 1 year Check out 30 year US treasury last price's stock ... - CNBC 10-year Treasury yield pulls back to 2.84% as investors rotate into bonds for safety 3 Hours Ago CNBC.com 10-year Treasury yield dips back below 3% after hotter-than-expected inflation data May 11 ...

Us treasury bonds coupon rate. Treasury Bond (T-Bond) - Overview, Mechanics, Example Treasury Bond Example Current Yield = 1 Year Coupon Payment / Bond Price = $25 / $950 = 2.63% Yield to Maturity (YTM) = 2.83% The yield to maturity (YTM) is essentially the internal rate of return (IRR) earned by an investor who holds the bond until maturity, assuming all coupon payments are made as scheduled and reinvested at the same rate. 10-Year US Treasury Note - Guide, Examples, Importance of ... Treasury notes are issued for a term not exceeding 10 years. The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market. Important Differences Between Coupon and Yield to Maturity For example, the U.S. Treasury might issue a 30-year bond in 2019 that's due in 2049 with a coupon of 2%. This means that an investor who buys the bond and owns it until 2049 can expect to receive 2% per year for the life of the bond, or $20 for every $1000 they invested. However, many bonds trade in the open market after they're issued. How does the U.S. Treasury decide what coupon rate to ... Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ...

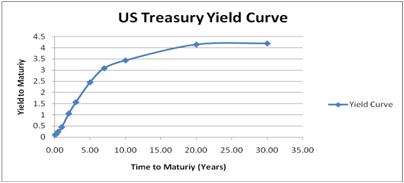

How Is the Interest Rate on a Treasury Bond Determined? If an investor purchases that same $10,000 bond for $9,500, then the rate of investment return isn't 5% - it's actually 5.26%. This is calculated by the annual coupon payment ($500) divided by the... Treasury Coupon Issues | U.S. Department of the Treasury The Yield Curve for Treasury Nominal Coupon Issues (TNC yield curve) is derived from Treasury nominal notes and bonds. The Yield Curve for Treasury Real Coupon Issues (TRC yield curve) is derived from Treasury Inflation-Protected Securities (TIPS). ... TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977 TNC Treasury Yield Curve Spot ... United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA. Treasury I-Bonds are Paying 7.12%! — Sapient Investments Treasury I-Bonds are Paying 7.12%! December 27, 2021 Inflation-Indexed Treasurys The U.S. Treasury offers two types of bonds that are indexed to inflation: 1) TIPS (Treasury Inflation-Protected Securities) and 2) Series I Bonds. They are different in many respects. TIPS pay a yield equal to the CPI plus or minus a certain percentage.

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an... Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Treasury Coupon Bonds - Economy Watch Treasury Coupon bonds are bonds issued by the US Treasury that come with semi-annual interest payments while the face values of the bonds are paid upon maturity. Compared to other types of negotiable bond issues, Treasury coupon bonds come with more frequent interest payments. Other types of bonds offer interest income on annual or biannual basis. Are most US treasury bonds which pay coupons of fixed ... Yes, most conventional Treasury bonds are issued with a coupon that is fixed for the life of the bond. For example, a 3% coupon bond will pay $15 in interest every 6 months—$30 per year on a bond with $1000 face value— no matter what. But there are exceptions: Bonds that mature in a year or less (called Treasury "Bills").

Bonds and Securities | U.S. Department of the Treasury TreasuryDirect.gov website These are just a few of the popular topics found at the TreasuryDirect.gov website: Log on to your TreasuryDirect account Create a new account in TreasuryDirect so you can buy and manage Treasury savings bonds and securities Forms Savings bonds as gifts Death of a savings bond owner Frequently asked questions The Bureau of the Fiscal Service The Bureau of the Fiscal ...

United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 2.904% yield. 10 Years vs 2 Years bond spread is 22.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.00% (last modification in May 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

MarketWatch: Stock Market News - Financial News - MarketWatch Treasurys selloff gains momentum in afternoon trading, with 2- to 30-year yields up by more than 10 basis points each; 10-year rate breaks above 2.8%. Apr. 14, 2022 at 12:52 p.m. ET by Vivien Lou ...

Zero Coupon Bond - Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

United States Government Bond 10Y - 2022 Data - 1912-2021 ... US 10 Year Note Bond Yield was 2.90 percent on Thursday May 19, according to over-the-counter interbank yield quotes for this government bond maturity. source: U.S. Department of the Treasury Historically, the United States Government Bond 10Y reached an all time high of 15.82 in September of 1981.

Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .)

US 10 year Treasury Bond, chart, prices - FT.com Dollar strengthens as global growth and inflation fears mount May 12 2022; Tether: stablecoin sees stable foundation shaken May 12 2022; European corporate bonds hit by steepest sell-off in at least 20 years May 12 2022; BlackRock slams 'micromanaging' climate proposals May 11 2022; Nasdaq Composite slides 3.2% as stock sell-off gathers pace May 11 2022 ...

US Treasury Bonds - Fidelity Investments The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Post a Comment for "44 us treasury bonds coupon rate"