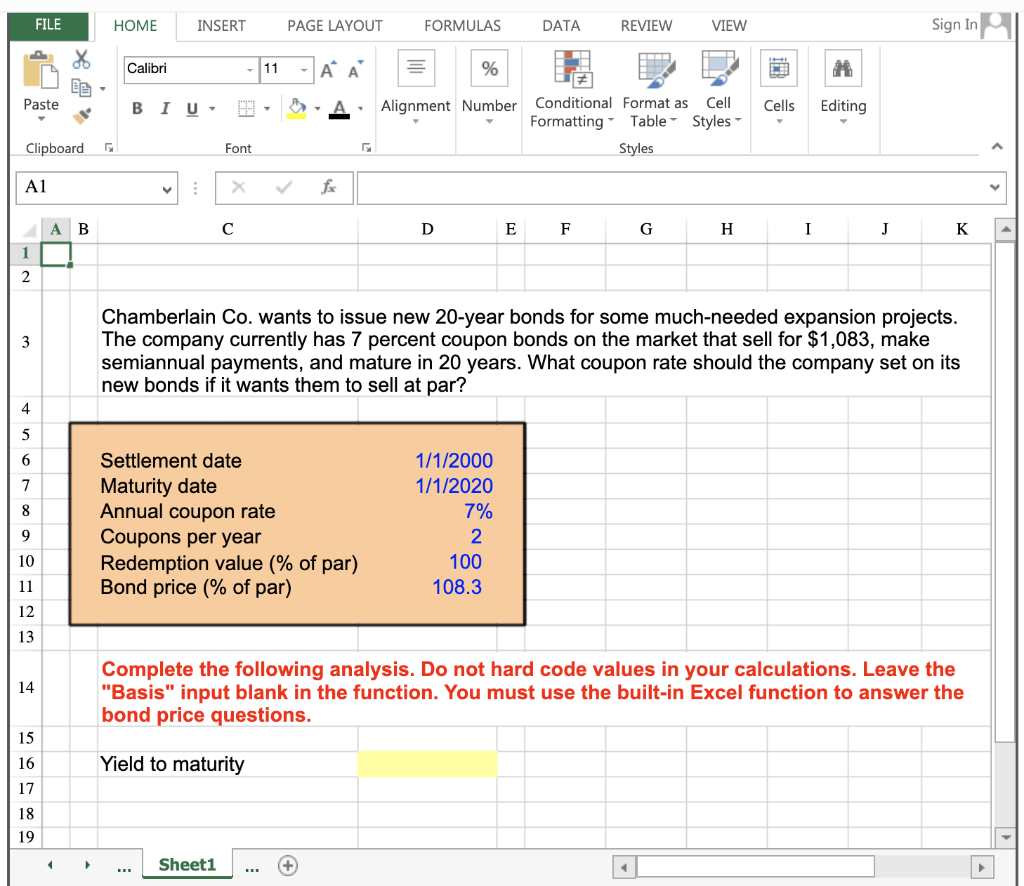

42 what coupon rate should the company set on its new bonds if it wants them to sell at par

Solved Chamberlain Co. wants to issue new 20-year bonds for Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market ... BDJ Co. wants to issue new 21-year bonds for some much-needed ... What coupon rate should the company set on its new bonds if it wants them to sell at par? Expansion: Expansion is the activity through which the business ...

Chamberlain Co. wants to issue new 20-year bonds for some much ... Jul 23, 2020 ... Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 6 percent coupon bonds ...

What coupon rate should the company set on its new bonds if it wants them to sell at par

Practice 7.b (YTM) Flashcards - Quizlet Chamberlain Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market ... Co. wants to issue new 19- year bonds for some necessary expansion what coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1000. i run into a problem with using the ... Solved Bond Yields Chamberlain Co. wants to issue new | Chegg.com Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that ...

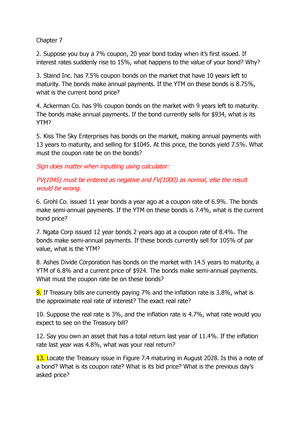

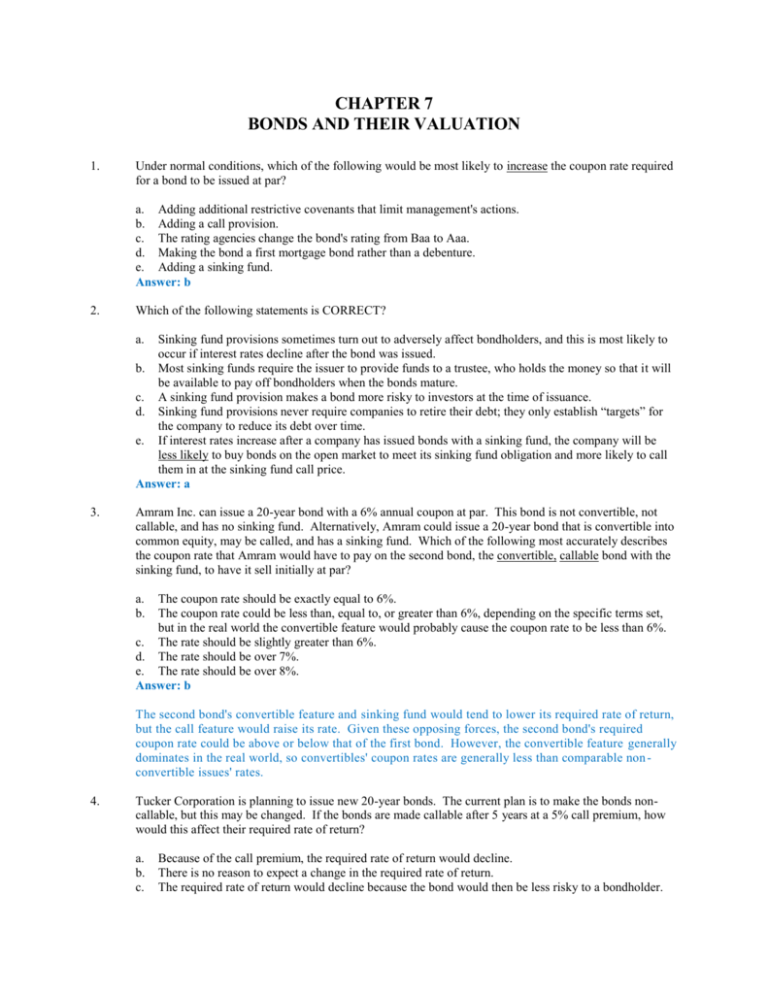

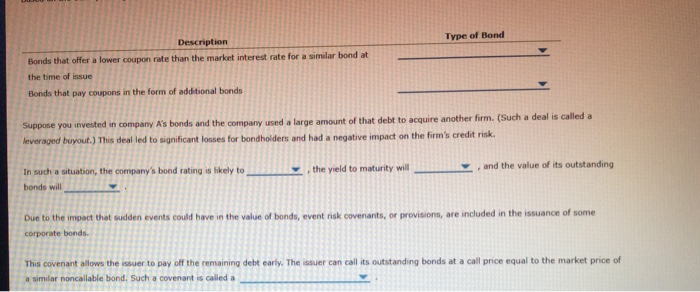

What coupon rate should the company set on its new bonds if it wants them to sell at par. Bond Coupon Interest Rate: How It Affects Price - Investopedia Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's par value, also known as the "face value." A $1,000 bond has a ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... For example: ABC Corp. releases a bond worth $1,000 at issue. Every six months it pays the holder $50. To calculate the bond coupon rate we add ... Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... The bond sells at a discount if its market price is below the par value. In such a situation, the yield-to-maturity is higher than the coupon ... Press Releases | U.S. Department of the Treasury Treasury Sanctions Individual, Banks, and Trading Company for Supporting North Korea’s WMD and Ballistic Missile Programs View All Press Releases Remarks and Statements

When a Bond's Coupon Rate Is Equal to Yield to Maturity A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ... Military Daily News, Military Headlines | Military.com Daily U.S. military news updates including military gear and equipment, breaking news, international news and more. Solved Bond Yields Chamberlain Co. wants to issue new | Chegg.com Chamberlain Co. wants to issue new 20-year bonds for some much-needed expansion projects. The company currently has 7 percent coupon bonds on the market that ... Co. wants to issue new 19- year bonds for some necessary expansion what coupon rate should the company set on its new bonds if it wants them to sell at par? Assume a par value of $1000. i run into a problem with using the ...

Practice 7.b (YTM) Flashcards - Quizlet Chamberlain Co. wants to issue new 18-year bonds for some much-needed expansion projects. The company currently has 9 percent coupon bonds on the market ...

Post a Comment for "42 what coupon rate should the company set on its new bonds if it wants them to sell at par"