45 coupon rate formula calculator

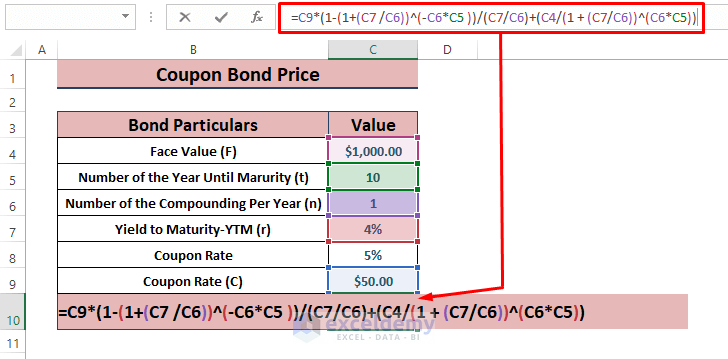

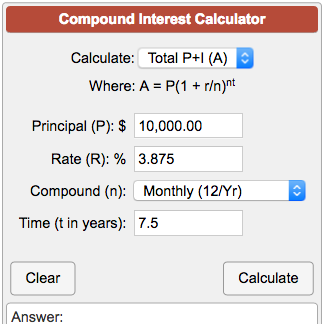

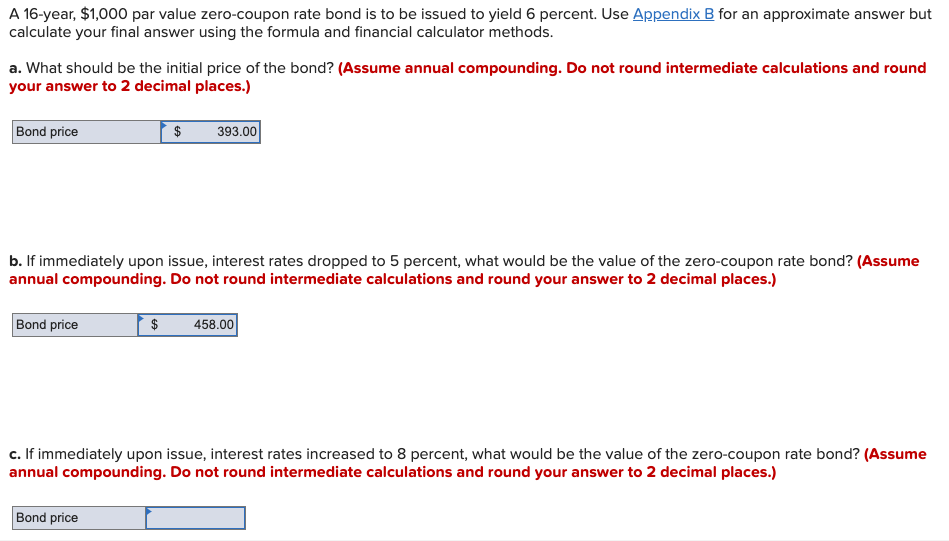

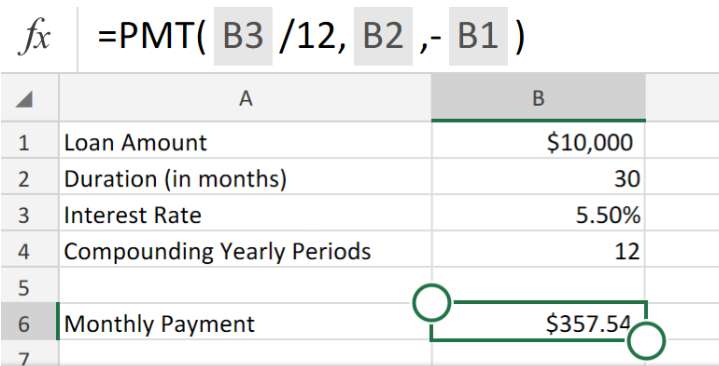

Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity Discount Factor Formula | Calculator (Excel template) - EDUCBA Let us see another example to understand functions. Discount Factor Formula – Example #3. We have to calculate the net present value with manual formula and excel function and discount factor for a period of 7 months, the discount rate for same is …

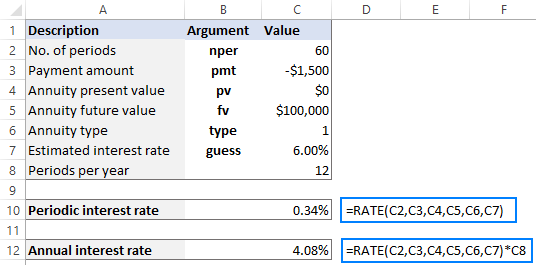

Annualized Rate of Return Formula | Calculator - EDUCBA The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. ... Annualized Rate of Return Formula Calculator. You can use the following Annualized Rate of Return Formula Calculator.

Coupon rate formula calculator

Discount Calculator 10% of $45 = 0.10 × 45 = $4.50. $45 - $4.50 = $40.50. or. 90% of $45 = 0.90 × 45 = $40.50. In this example, you are saving 10%, or $4.50. A fixed amount off of a price refers to subtracting whatever the fixed amount is from the original price. For example, given that a service normally costs $95, and you have a discount coupon for $20 off ... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate How To Find Coupon Rate Of A Bond On Financial Calculator With this information, you can use the following formula: Coupon Rate = (Coupon Payment / Par Value) x 100. For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5%

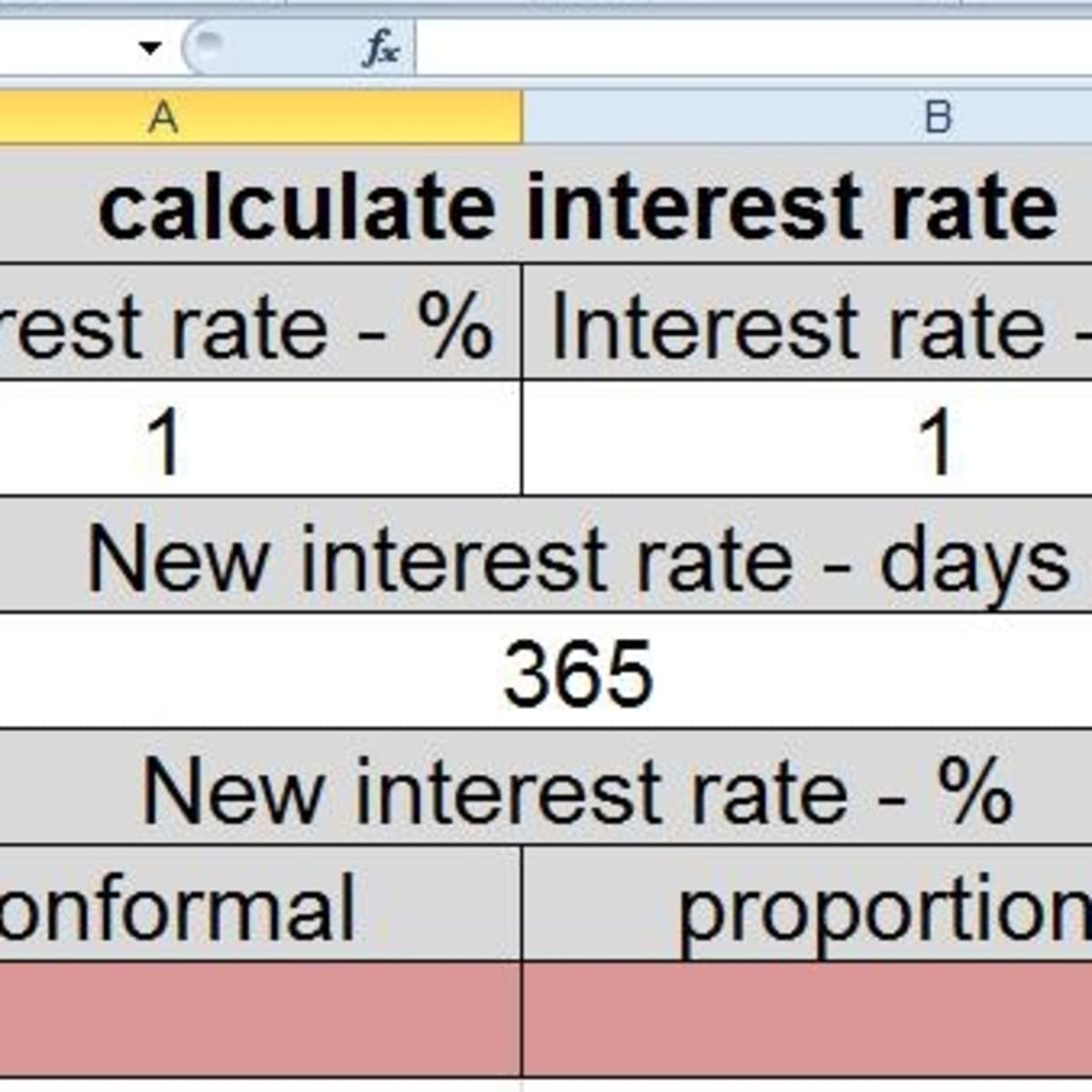

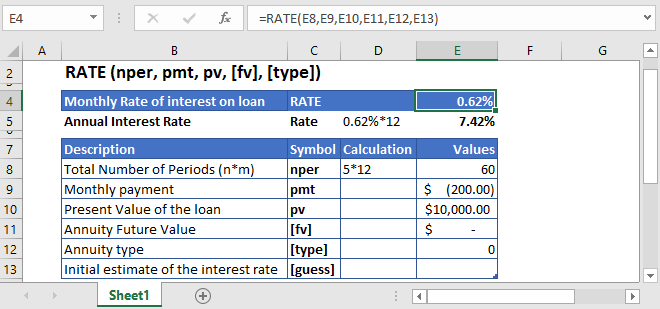

Coupon rate formula calculator. Discount Formula | Calculator (Examples with Excel Template) Discount Rate = $75 / $300 * 100% Discount Rate = 25%; Therefore, the bundle discount and discount rate offered on the shirts are $75 and 25% respectively. Explanation. The first formula for discount can be computed by using the following steps: Step 1: Firstly, figure out the listed price of the product which is the price printed on it. › calculator › interest-rateInterest Rate Converter Calculator Use our Interest Rate Converter Calculator to quickly convert Annual Percentage Rates to monthly interest rates and monthly interest rates into an APR. With so many different short-term loan vehicles and other financial products available to consumers, deciphering the interest you are paying or the interest that is being paid to you can be very difficult. Coupon Rate Formula & Calculation - Study.com Convert the resulted coupon rate to percentage terms by multiplying the resulted quotient by 100. All the mentioned above steps can be summarized in the coupon rate formula that is given such as:... Interest Rate Converter Calculator Use our Interest Rate Converter Calculator to quickly convert Annual Percentage Rates to monthly interest rates and monthly interest rates into an APR. With so many different short-term loan vehicles and other financial products available to consumers, deciphering the interest you are paying or the interest that is being paid to you can be very difficult.

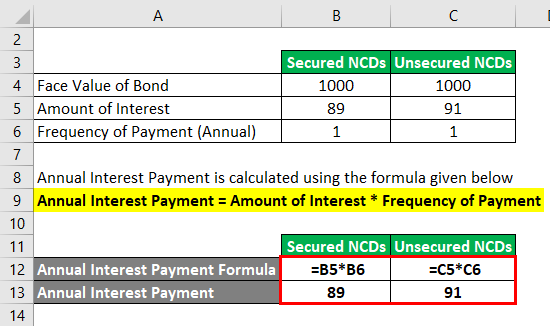

Coupon Rate Calculator | Solution Step by Step 🥇 The coupon rate is the percentage of an issued security's face value that is paid out as interest by the issuer. The formula for calculating a bond's coupon rate is: \text {Coupon Rate} = \frac {\text {Coupon Payments}} {\text {Face Value}} The coupon rate is often expressed as a percentage, but it can also be expressed in decimal form. Current Yield Calculator | Calculate Current Yield of a Bond Current Yield Formula: Current Yield = Coupon Payment / Market Price of Bond ... Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield in a matter of seconds is to just enter in the face value of the bond, the bond coupon rate percentage, and the market price of the bond. That’s it! Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Formula: Coupon Rate = (Coupon Payment × No of Payment) / Face Value Finance Calculators Active Return Coupon Rate of a Bond (Formula, Definition) | Calculate Coupon Rate The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula Calculator; Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity. Once fixed at the issue date, coupon rate of bond remain unchanged till the ... What Is Coupon Rate and How Do You Calculate It? - SmartAsset To calculate the bond coupon rate we add the total annual payments and then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10%. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate. › annualized-rate-of-return-formulaAnnualized Rate of Return Formula | Calculator | Example ... The bond paid coupon at the rate of 6% per annum for the next 10 years until its maturity on December 31, 2014. Calculate the annualized rate of return earned by the investor from the bond investment. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

how to calculate bond yield to maturity in excel? To calculate time to maturity, you'll need to know the bond's coupon rate and current market value. Then, you can use this formula: Time to Maturity = (Coupon Rate / Current Market Value) x Number of Years to Maturity. For example, let's say you have a $1,000 bond with a 5% coupon rate that matures in 10 years.

Coupon Payment Calculator Coupon payment = face value * (annual coupon rate / number of payments per year) = $1,000 * (10% / 2) = $1,000 * 5% = $50 With the coupon payment calculator, you can find the periodic coupon payment for any bond by simply inputting the number of payments per year on the bond indenture.

Coupon Rate Calculator Formula: Coupon Rate = (Coupon Payment x No of Payment) / Face Value Note: n = 1 (If Coupon amount paid Annual) n = 2 (If Coupon amount paid Semi-Annual) Coupon percentage rate is also called as the nominal yield. In other words, it is the yield the bond paid on its issue date.

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate Formula; Examples of Coupon Rate Formula (With Excel Template) Coupon Rate Formula Calculator; Coupon Rate Formula. Coupon Rate is the interest rate that is paid on a bond/fixed income security. It is stated as a percentage of the face value of the bond when the bond is issued and continues to be the same until it reaches maturity.

Effective Tax Rate Formula | Calculator (Excel Template) - EDUCBA So if we say effective tax rate of company A is 18.5% and B is 21.3%, this will be a more accurate reflection of a company’s tax liability. Effective Tax Rate Formula Calculator. You can use the following Effective Tax Rate Calculator

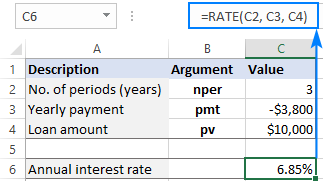

How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or...

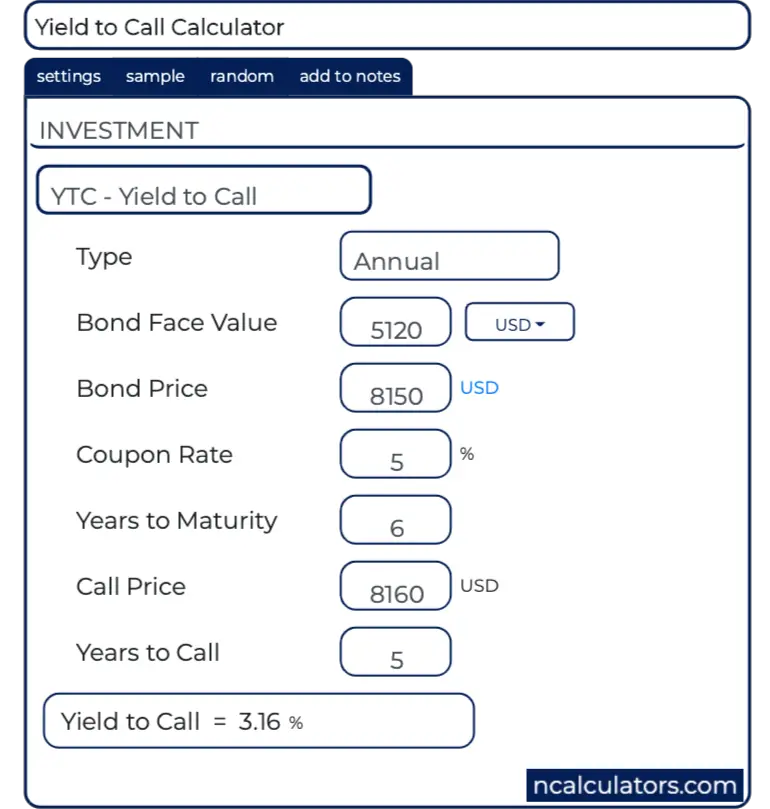

dqydj.com › bond-yield-to-call-calculatorBond Yield to Call (YTC) Calculator - DQYDJ Coupon Payment Frequency - How often the bond makes coupon payments. Bond YTC Calculator Outputs. Yield to Call (%): The converged upon solution for the yield to call of the current bond (the internal rate of return assuming the bond is called). Current Yield (%): The simple calculated yield which uses the current trading price and face value ...

Bond Yield Calculator | Calculate Bond Returns Calculate the bond yield. The bond yield can be seen as the internal rate of return of the bond investment if the investor holds it until it matures and reinvesting the coupons at the same interest rate. Hence, the bond yield formula involves deducing the bond yield r in the equation below: bond price = Σ k=1n [cf / (1 + r) k], where.

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity.

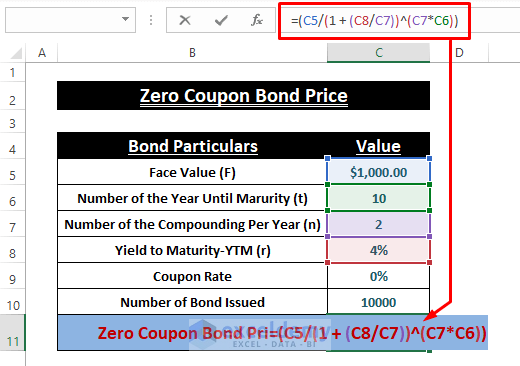

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a …

Bond Yield to Call (YTC) Calculator - DQYDJ On this page is a bond yield to call calculator.It automatically calculates the internal rate of return (IRR) earned on a callable bond assuming it's called at the first possible time. Importantly, it assumes all payments and coupons are on time (no defaults). Also, find the approximate yield to call formula below. Like with Yield to Maturity (YTM), Yield to Call is an iterative calculation.

Coupon Rate Of A Bond Formula Definition Calculate Coupon Rate Value of sum value bond of coupon the face coupon as par dividing amount of of the is also rate rate- be by bond- the be mathematically represented interest 100 Home News

› discount-formulaDiscount Formula | Calculator (Examples with Excel Template) Discount Rate = $75 / $300 * 100% Discount Rate = 25%; Therefore, the bundle discount and discount rate offered on the shirts are $75 and 25% respectively. Explanation. The first formula for discount can be computed by using the following steps: Step 1: Firstly, figure out the listed price of the product which is the price printed on it.

Coupon Rate: What is the Coupon Rate? - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the interest rate pricing on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6%

› effective-tax-rate-formulaEffective Tax Rate Formula | Calculator (Excel Template) - EDUCBA So if we say effective tax rate of company A is 18.5% and B is 21.3%, this will be a more accurate reflection of a company’s tax liability. Effective Tax Rate Formula Calculator. You can use the following Effective Tax Rate Calculator

Coupon Rate Formula | Simple-Accounting.org A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value.As a simple example, consider a zero coupon bond with a face, or par, value of $1200, and a maturity of one year.

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

How To Find Coupon Rate Of A Bond On Financial Calculator With this information, you can use the following formula: Coupon Rate = (Coupon Payment / Par Value) x 100. For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5%

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · The annual coupon payment is the product of the two, as seen in the formula below: annual coupon payment = coupon payment per period * coupon frequency. As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate

Discount Calculator 10% of $45 = 0.10 × 45 = $4.50. $45 - $4.50 = $40.50. or. 90% of $45 = 0.90 × 45 = $40.50. In this example, you are saving 10%, or $4.50. A fixed amount off of a price refers to subtracting whatever the fixed amount is from the original price. For example, given that a service normally costs $95, and you have a discount coupon for $20 off ...

:max_bytes(150000):strip_icc()/Interest-formula_7-589b92f45f9b58819cafefaf.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "45 coupon rate formula calculator"