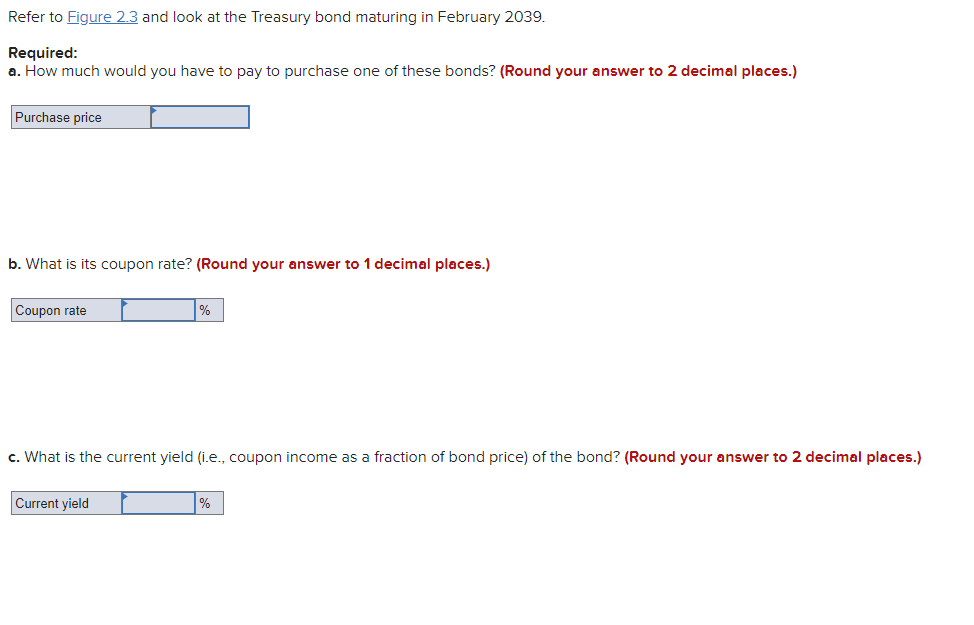

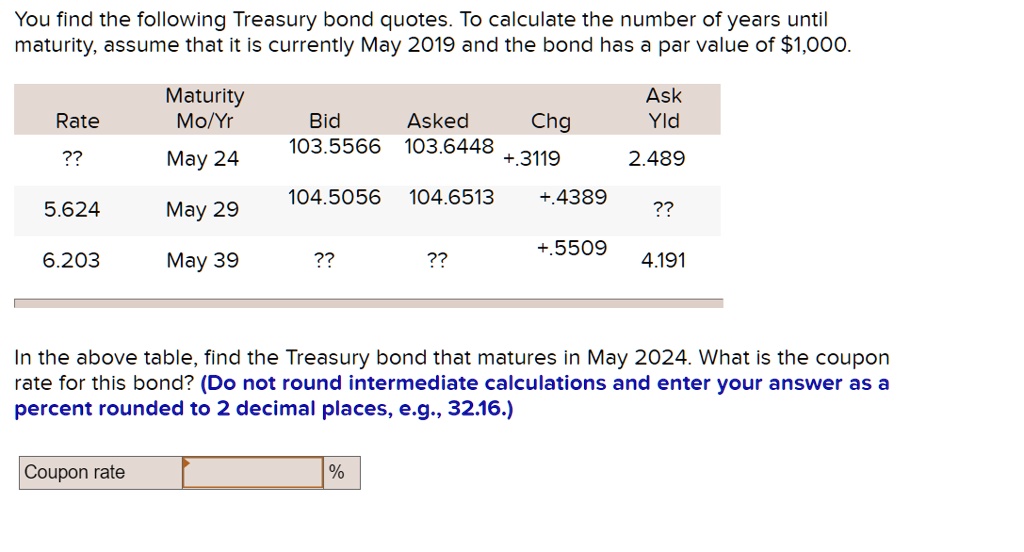

41 coupon rate treasury bond

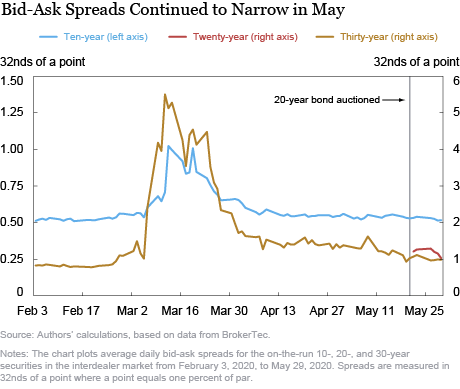

USFR - WisdomTree Floating Rate Treasury Fund | WisdomTree Sep 27, 2022 · The issuance of floating rate notes by the U.S. Treasury is new and the amount of supply will be limited. Fixed income securities will normally decline in value as interest rates rise. The value of an investment in the Fund may change quickly and without warning in response to issuer or counterparty defaults and changes in the credit ratings of ... 30 Year Treasury Rate - 39 Year Historical Chart | MacroTrends 30 Year Treasury Rate - 39 Year Historical Chart. Interactive chart showing the daily 30 year treasury yield back to 1977. The U.S Treasury suspended issuance of the 30 year bond between 2/15/2002 and 2/9/2006. The current 30 year treasury yield as of September 27, 2022 is 3.87%.

Treasury Bond Issuance held on 10 August 2022 - Central Bank of … Public Debt Department Treasury Bond Issuance held on 10 August 2022 The date of settlement is 15 August 2022. Series 17.00%2025 ‘A’ 20.00%2029 ‘A’ Date of Maturity 01 June 2025 15 July 2029 ISIN* LKB00425F013 LKB00729G156 Coupon Rate (p.a.) (%) …

Coupon rate treasury bond

Bond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading … Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ... ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news.

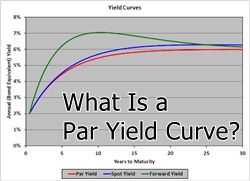

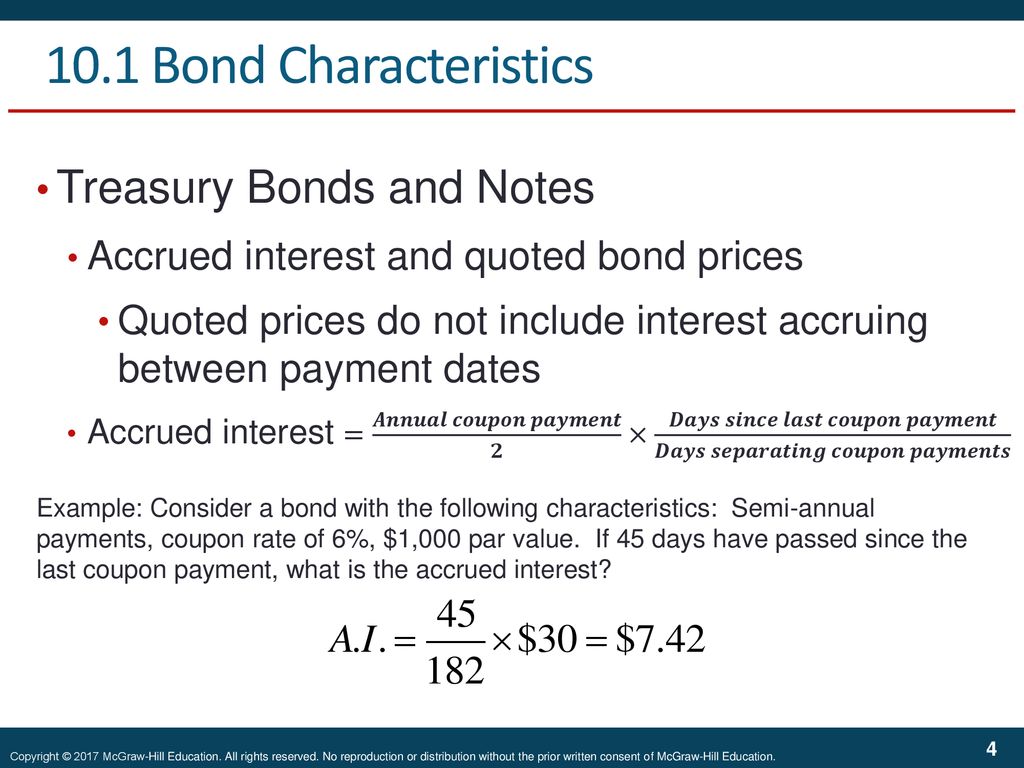

Coupon rate treasury bond. Zero-Coupon Bond - Definition, How It Works, Formula 28/01/2022 · Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future – an investor would prefer to receive $100 today than … 10-Year High Quality Market (HQM) Corporate Bond Spot Rate The spot rate for any maturity is defined as the yield on a bond that gives a single payment at that maturity. This is called a zero coupon bond. Because high quality zero coupon bonds are not generally available, the HQM methodology computes the spot rates so as to make them consistent with the yields on other high quality bonds. The HQM yield ... How Is the Interest Rate on a Treasury Bond Determined? Aug 29, 2022 · A Treasury bond pays a "coupon rate." This is the percentage return paid to the investor periodically until its maturity date. Treasury bonds also are traded in the market. As fewer payments ... ZROZ PIMCO 25+ Year Zero Coupon US Treasury Index ETF Learn everything about PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ). Free ratings, analyses, holdings, benchmarks, quotes, and news.

Advantages and Risks of Zero Coupon Treasury Bonds 31/01/2022 · If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive ... Bond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading …

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "41 coupon rate treasury bond"