45 coupon rate and market rate

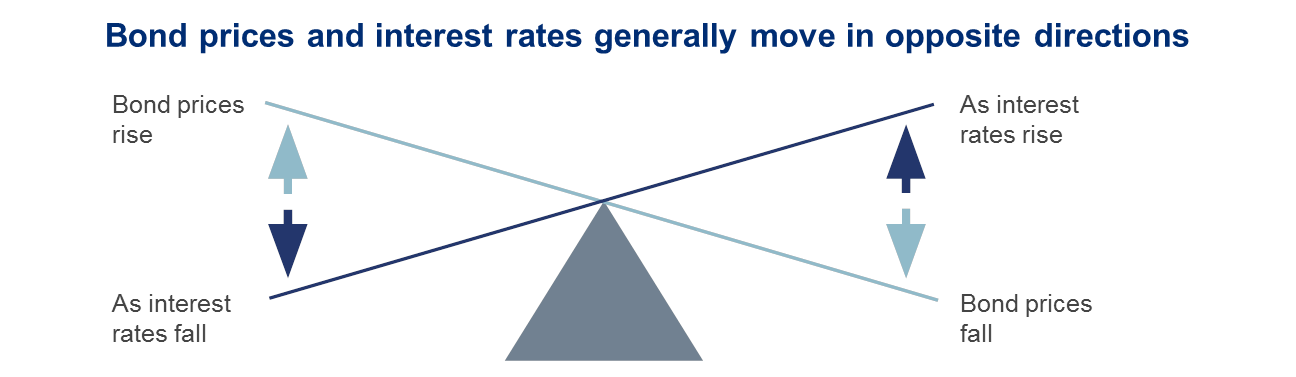

Is coupon rate same as interest rate? - misc.jodymaroni.com Conversely, a bond with a coupon rate that's higher than the market rate of interest tends to raise the price. If the general interest rate is 3% but the coupon is 5%, investors rush to purchase the bond , in order to snag a higher investment return. The Difference between a Coupon and Market Rate Coupon rate is the interest rate to be paid on the bond at regular interval. In this case coupon rate is 8%. If the face value of the bond is $1000, the holder of the bond will receive $80 at the end of every year during the duration of the bond. In addition the bond holder will receive $1000 back on the maturity of the ... Solution Summary

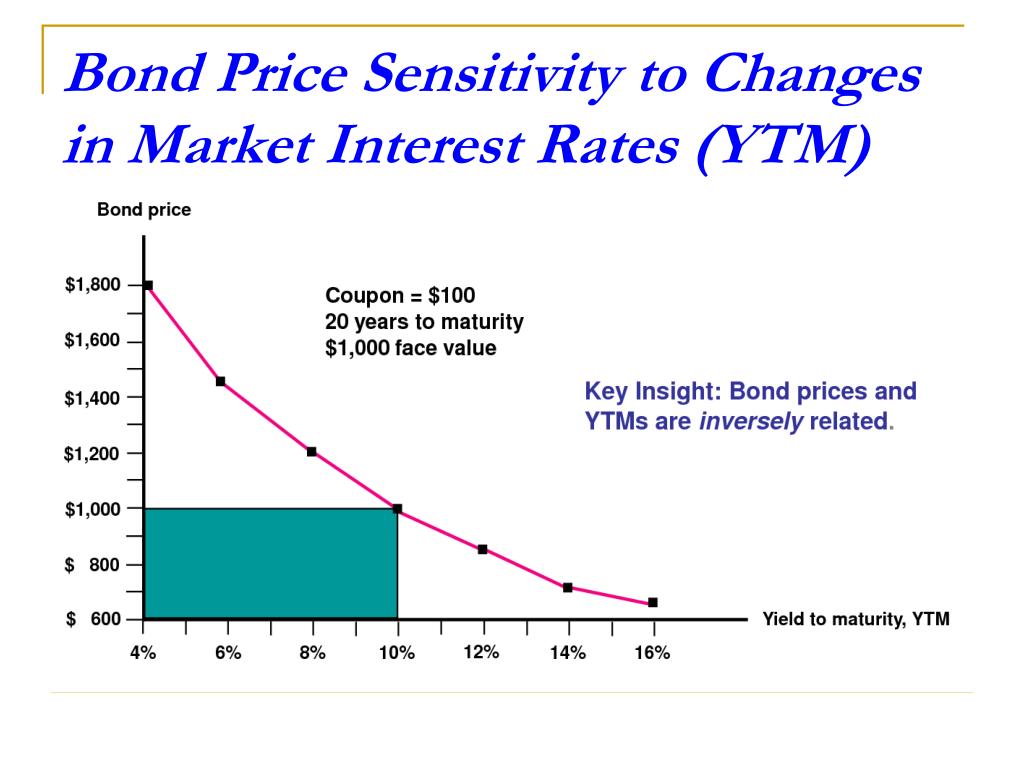

› coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... The bond price varies based on the coupon rate and the prevailing market rate of interest. If the coupon rate is lower than the market interest rate, then the bond is said to be traded at a discount, while the bond is said to be traded at a premium if the coupon rate is higher than the market interest rate.

Coupon rate and market rate

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Difference Between Coupon Rate and Interest Rate What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) If the investor purchases a bond of 10 years, of the face value of $1,000, and a coupon rate of 10 percent, then the bond purchaser gets $100 every year as coupon payments on the bond. If a bank has lent $ 1000 to a customer and the interest rate is 12 percent, then the borrower will have to pay charges $120 per year.

Coupon rate and market rate. Solved What is the difference between a bond's coupon rate | Chegg.com The market rate is the rate of return expected by investors who purchase the bonds. The market rate is the rate specified on the face of the bond. The coupon rate is; Question: What is the difference between a bond's coupon rate and its market interest rate (yield)? O Coupon rate and market rate are same. The coupon rate is the rate specified ... Do coupon rates change? Explained by FAQ Blog What happens to the coupon rate of A $1000 face value bond that pays $80 annually in interest if market interest rates change from 9% to 10 %? What happens to the coupon rate of a $1,000 face value bond that pays $80 annually in interest if market interest rates change from 9% to 10%? ... Its current yield is lower than its coupon rate. If a ... Bond's Price, Coupon Rate, Maturity | CFA Level 1 - AnalystPrep Solution. The correct answer is B. The bond price is most likely to change by less than 4% as the relationship between the bond's price and the market discount rate is not linear (convexity effect). Featured. Monetary and Nonmonetary Benefits Affecting the Value and Price of a Forward Contract. Concepts of Arbitrage, Replication and Risk ... › indices › prime-ratePrime Rate - Prime Rate History From 1979 to 2022 - HSH.com What is the Prime Rate? The prime rate is defined by The Wall Street Journal (WSJ) as "The base rate on corporate loans posted by at least 70% of the 10 largest U.S. banks." It is not the 'best' rate offered by banks. HSH uses the print edition of the WSJ as the official source of the prime rate.

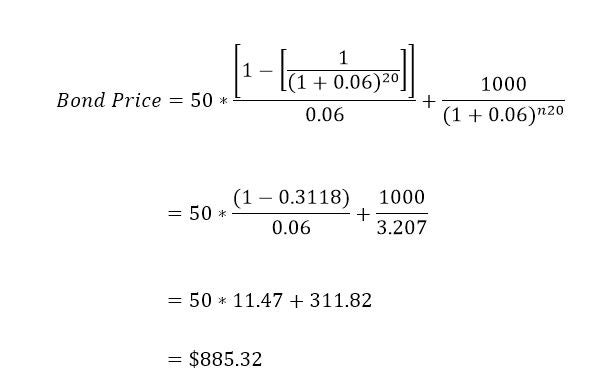

Bond Coupon Interest Rate: How It Affects Price - Investopedia When the prevailing market rate of interest is higher than the coupon rate—say there's a 7% interest rate and a bond coupon rate of just 5%—the price of the bond tends to drop on the open market... › silver-rateSilver Rate Today: Current Silver Price in India Today : 07 ... Jul 07, 2022 · Thus, the spot gold price in India is growing at a slower rate of 0.02% than the 0.06% which is the rate at which the global spot gold prices are increasing. Moreover, the global price of platinum has also taken a hit as it fell to $983.5 per Troy ounce with a plunge of 1.8%. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond.

Par Bond - Overview, Bond Pricing Formula, Example Example 3: Par Bond. Consider a bond with a 5-year maturity and a coupon rate of 5%. The market interest rate is 5%. For the bond above, the coupon rate is equal to the market interest rate. In such a scenario, a rational investor would only be willing to purchase the bond at par to its face value because its coupon return is the same as the ... Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 per cent, you will get Rs 200 every year for 10 years, no matter what happens to the bond price in the market. Coupon rate - definition and meaning - Market Business News That bond's coupon rate is the percentage you receive in one year. You receive $50. Therefore, its coupon rate is $5% of $1,000. The coupons never change, regardless of what price the bond trades for, you will always get $50 per year. If you sell your bond at a $200 premium, its yield is now equal to 4.16% ($50 ÷ $1,200 x 100 = 4.16%).

Bond Stated Interest Rate Vs. Market Rate | Pocketsense Because of the manner in which bonds are traded, the coupon rate often differs from the market interest rate. Tips A coupon rate is a fixed rate of return attached to the face value of the bond paid to the purchaser from the seller, while the market interest rate can change dramatically throughout the lifespan of the bond. Bond Basics

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · A bond's coupon rate is the interest earned on the bond over its lifetime, while its yield to maturity reflects its changing value in the secondary market.

Finance exam 2 Flashcards | Quizlet The coupon rate determines the periodic interest payments made to investors. YTM is the expected return for an investor who buys the bond today and holds it to maturity. YTM is the prevailing market interest rate for bonds with similar features. Which of the following terms apply to a bond? Coupon rate Dividend yield Time to maturity Par value

A Bond's Price given a Market Discount Rate - AnalystPrep If the bond has a coupon rate of 7% and the market discount is 6%, its price would be 104.21, and it would be trading at a premium. P V bond = 7 1.061 + 7 1.062 + 7 1.063 + 7 1.064 + 107 1.065 = 104.21 P V b o n d = 7 1.06 1 + 7 1.06 2 + 7 1.06 3 + 7 1.06 4 + 107 1.06 5 = 104.21

Solved When are the coupon rate of a bond and the market | Chegg.com - When the bond is issued. - The coupon rate changes over the life of a bond to keep it in line with the market rate of interest. - Never because corporations issuing bonds must always give a premium in coupon rates over the market rate of; Question: When are the coupon rate of a bond and the market rate of interest most likely to be the same ...

What is the difference between coupon rate and market The discount rate is useful in determining the current value of money. Market rate of return is different from discount rate, (if the market rate of returns is equal to the value which is formulated from the results of the discount method), then the source is fairly traded.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. However, if the market rate of interest is higher than 20%, then the bond will be traded at discount. Coupon Rate Formula - Example #2

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

What Is A Coupon Value? Definition And Calculation What is a coupon rate? It is the interest rate paid by the issuer to investors. As market conditions change, the bond price changes, impacting the yield and changing the bond value. Bond yields ...

› coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Based on the coupon rate and the prevailing market rate of interest, it can be determined whether a bond will trade at a premium, par, or discount. A bond trades at a premium Bond Trades At A Premium A premium bond refers to a financial instrument that trades in the secondary market at a price exceeding its face value. This occurs when a bond ...

› terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Difference Between Coupon Rate and Discount Rate the main difference between the coupon rate and the discount rate is that a coupon rate alludes to the rate which is determined on the face worth of the security, i.e., it is the yield on the proper pay security that is generally affected by the public authority set discount rates, and it is usually settled by the backer of the guards while …

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

What Is Coupon Rate and How Do You Calculate It? Coupon Rate vs. Yield. While coupon rate is the percentage that a bond returns based on its initial face value, yield refers to a bond's return based on its secondary market sale price. It is what the bond is worth to its current holder. When the current holder is the initial purchaser of the bond, coupon rate and yield rate are the same.

› files › ib_interestrateriskInvestor BulletIn Interest rate risk — When Interest rates Go ... For example, imagine one bond that has a coupon rate of 2% while another bond has a coupon rate of 4%. All other features of the two bonds—when they mature, their level of credit risk, and so on—are the same. If market interest rates rise, then the price of the bond with the 2% coupon rate will fall more than that of the bond with the 4%

Difference Between Coupon Rate and Interest Rate The main difference between Coupon Rate and Interest Rate is that the coupon rate has a fixed rate throughout the life of the bond. Meanwhile, the interest rate changes its rate according to the bond yields. The coupon rate is the annual rate of the bond that has to be paid to the holder.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) If the investor purchases a bond of 10 years, of the face value of $1,000, and a coupon rate of 10 percent, then the bond purchaser gets $100 every year as coupon payments on the bond. If a bank has lent $ 1000 to a customer and the interest rate is 12 percent, then the borrower will have to pay charges $120 per year.

:max_bytes(150000):strip_icc()/GettyImages-182800841-5894f4825f9b5874ee438219.jpg)

Post a Comment for "45 coupon rate and market rate"