39 payment coupon for irs

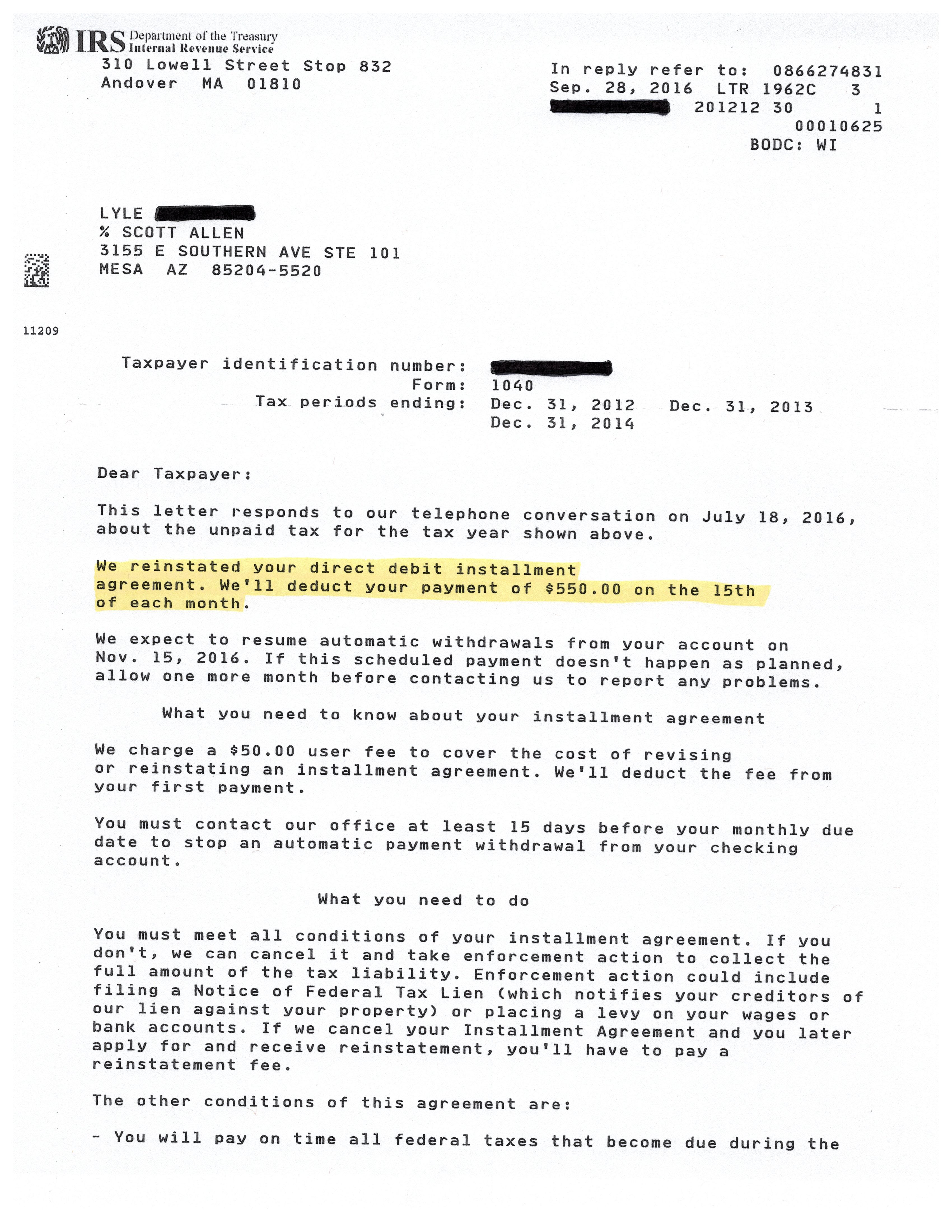

Make a Payment | Minnesota Department of Revenue Individuals: Use the e-Services Payment System Some tax software lets you make or schedule payments when you file. To cancel a payment made through tax software, you must contact us. Call 651-556-3000 or 1-800-657-3666 (toll-free) at least three business days before the scheduled payment date. Businesses: Log in to e-Services PDF Form 656-PPV Offer in Compromise - Periodic Payment Voucher Form . 656-PPV (Rev. 4-2020) Form . 656-PPV (April 2020) Department of the Treasury - Internal Revenue Service. Offer in Compromise - Periodic Payment Voucher. If you filed an offer in compromise (offer) and the offered amount is to be paid within 6 to 24 months (Periodic Payment Offer) you must

Tax Deals & Coupons for 2022 Tax Preparation 20% Off Coupon - Personal Tax Extensions 2 uses today Sale Save 20% on H&R Block Software Products! 4 uses today Code 10% Off Sitewide 2 uses today Code 15% Off Sitewide 1 use today Code 20% Off Your Order 1 use today Code Call (888) 797-7854 And Get One Month FREE Payroll Service. 1 use today Sale Instant 6 Month Tax Extension 1 use today Code

Payment coupon for irs

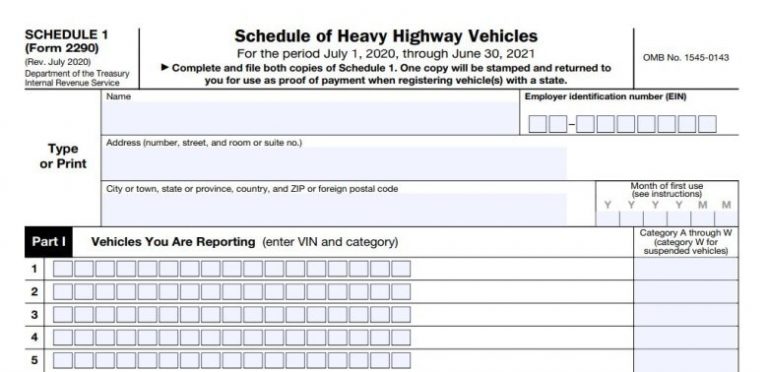

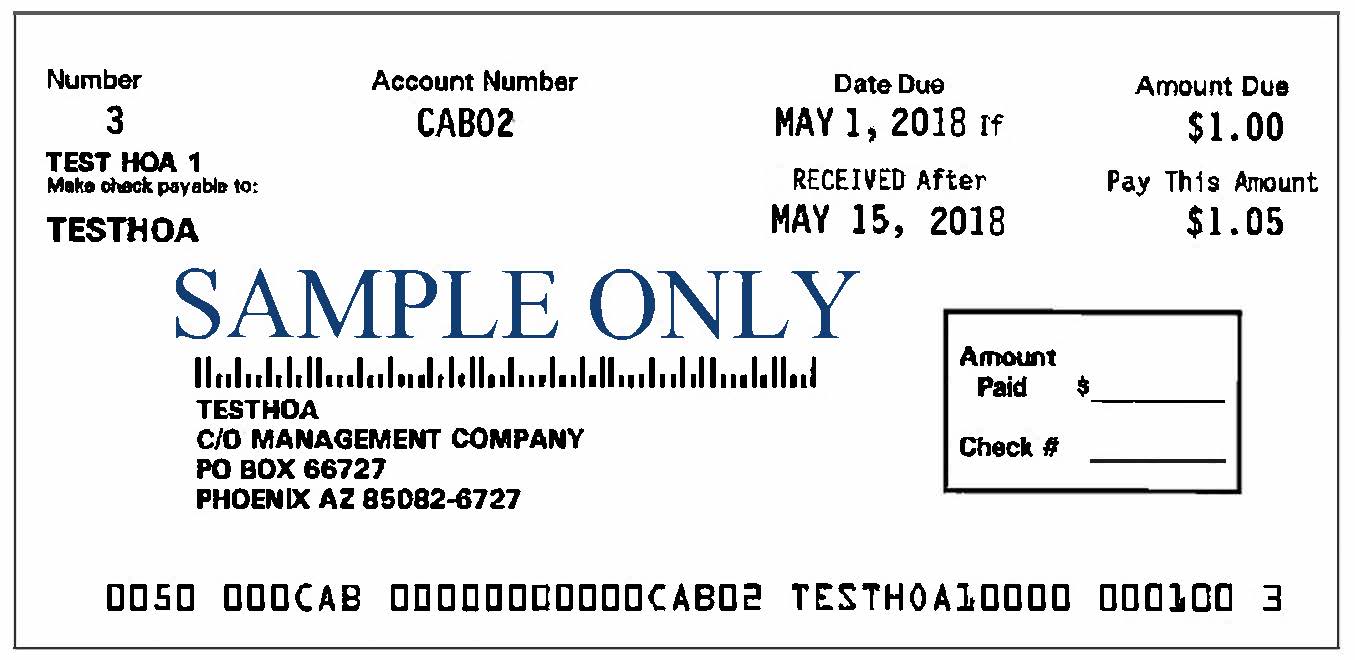

PDF 2021 Form 1040-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form 1040-V Department of the Treasury Internal Revenue Service (99) Payment Voucher Do not staple or attach this voucher to your payment or return. Go to for payment options and information. OMB No. 1545-0074 2020 Print or type 1 Your social security number (SSN) PDF 2021 Payment Coupon (IL-501) and Instructions Most taxpayers who use payment coupons are considered monthly payers. Monthly payers must pay by the 15th day of each month for amounts withheld the preceding month. You may pay more frequently using one of our electronic methods or preprinted payment coupons. Do not use your return, Form IL-941, to pay more frequently. PDF Sample Tax Payment Coupon - Michigan Sample Tax Payment Coupon - Michigan

Payment coupon for irs. Where can I find a payment voucher to print and send in for a tax owed? Click down-arrow next to My Account (top right, next to the Search box). Click on Print Center. Click on Print, save or preview this year's return. Under Choose your option:, select Forms filed with the government (shortest version w/filing instructions); Forms filed with the government plus all worksheets (w/filing instructions); or All forms ... Payments | Internal Revenue Service Sign In to Pay and See Your Payment History. For individuals only. View the amount you owe, your payment plan details, payment history, and any scheduled or pending payments. Make a same day payment from your bank account for your balance, payment plan, estimated tax, or other types of payments. Go to Your Account. PDF 2021 Instructions for Form FTB 3582 Pay the amount you owe using our secure online payment service. Go to ftb.ca.gov/pay If you pay online, do not complete or mail the voucher below. Credit Card - Use your major credit card. Call 800.272.9829 or go to officialpayments.com , use code 1555. PDF 2021 Form 770-PMT, Payment Coupon - tax.virginia.gov COMPLETE THE PAYMENT COUPON BY INCLUDING THE FOLLOWING INFORMATION: The FEIN of the estate, trust or Pass-Through entity filing a Unified Nonresident return. This must match the information on the return. The phone number of the estate, trust or Pass-Through entity filing a Unified Nonresident return.. The amount of the enclosed payment.

About Form 1041-V, Payment Voucher | Internal Revenue Service Forms and Instructions About Form 1041-V, Payment Voucher About Form 1041-V, Payment Voucher Submit this voucher with your check or money order for any balance due on an estate's or trust's Form 1041. Current Revision Form 1041-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1041-V Revisions IRS payment options | Internal Revenue Service 2019 Tax Liability - If paying a 2019 income tax liability without an accompanying 2019 tax return, taxpayers paying by check, money order or cashier's check should include Form 1040-V, Payment Voucher with the payment. Mail the payment to the correct address by state or by form. Do not send cash through the mail. IRS Payment Options With a 1040-V Payment Voucher As of the 2020 tax year, it ranges from $31 to $225, depending on how you make your payment. There are options and reduced fees available to low-income taxpayers who qualify. This is a one-time fee that's paid upfront. It is often part of your first payment. 4 You can apply for an installment agreement on the IRS website if you owe $50,000 or less. PDF 2022 Form 1040-ES - IRS tax forms Internal Revenue Service Purpose of This Package Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method used to pay tax on income that isn't subject to withholding (for example, earnings from self-employment, interest, dividends, rents, alimony, etc.). In addition, if you don't elect voluntary withholding,

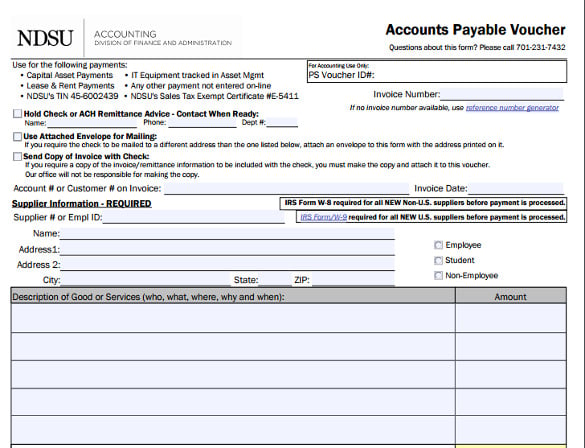

Payment Vouchers | Arizona Department of Revenue - AZDOR Payment Vouchers. AZ‑140V. Arizona Individual Income Tax payment Voucher for Electronic Filing (This form has no separate instructions) Payment Vouchers. MET-1V. Arizona Marijuana Excise Tax Return Efile Return Payment Voucher. Payment Vouchers. TPT-V. Arizona Transaction Privilege Tax Efile Return Payment Voucher. Payment Coupon Templates - 11+ Free Printable PDF Documents Download Easy To Edit Payment Coupon Template Download. For business tax payments, this example template can be used when making payments in the state of Michigan. It clearly separates the various taxes like sales tax, use tax, withholding tax and interests. ftb.ca.gov. Free Download. IRS Mailing Address: Where to Mail IRS Payments File Here is a clear guide on how to fill in IRS Form 1040 using PDFelement. Step 1. Import IRS Form 1040 into PDFelement You need to launch PDFelement on your device and access "Open Files" to import Form 1040 for filling it out across the platform. Try It Free Step 2. Fill Out Appropriate Fields of Irs Form 1040 PDF Draft 2021 Form 760-PMT, Payment Coupon - tax.virginia.gov COMPLETE THE PAYMENT COUPON BY INCLUDING THE FOLLOWING INFORMATION: Your Social Security Number (SSN) and Spouse's SSN (if filing a joint return). This must match the information on your return. Your name and spouse's name (if filing a joint return), address, and phone number. The amount of the enclosed payment.

Forms and Publications (PDF) - IRS tax forms Payment Voucher 2021 12/14/2021 Form 1041-V: Payment Voucher 2021 11/12/2021 Form 8283-V: Payment Voucher for Filing Fee Under Section 170(f)(13) 0813 10/28/2013 Form 8813: Partnership Withholding Tax Payment Voucher (Section 1446) 1208

7 Ways To Send Payments to the IRS Tax Day is April 18 in 2022. Tax payments are due by the filing deadline. An extension of time to file your return doesn't also extend your time to make payment. The IRS provides internet options for payment, or you can visit one of its retail partners or mail your payment through the U.S. Postal Service.

Form 1040-V: Payment Voucher Definition - Investopedia Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. 1 The...

About Form 1040-V, Payment Voucher | Internal Revenue Service About Form 1040-V, Payment Voucher Form 1040-V is a statement you send with your check or money order for any balance due on the "Amount you owe" line of your Form 1040 or 1040-NR. Current Revision Form 1040-V PDF Recent Developments None at this time. Other Items You May Find Useful All Form 1040-V Revisions Paying Your Taxes

IRS Direct Pay Redirect Make estimated tax payments in advance of the timely filing of your return. Depending on your income, your payment may be due quarterly, or as calculated on Form 1040-ES, Estimated Tax for Individuals. You do not have to indicate the month or quarter associated with each payment. CP2000/CP2501/CP3219A.

Federal Form 1040-V (Payment Voucher) - TaxFormFinder If you owe any tax, you must file a payment voucher along with your payment, if paying in the form of a check or money order. We last updated the Payment Voucher in January 2022, so this is the latest version of Form 1040-V , fully updated for tax year 2021.

IRS Form 8962 Download Fillable PDF or Fill Online Premium Tax Credit (Ptc) - 2018 | Templateroller

PDF 2021 Form 1041-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form. 1041-V. 2021. Payment Voucher. Department of the Treasury Internal Revenue Service (99) . Make your check or money order payable to "United States Treasury" . Don't staple or attach this voucher to your payment or return. OMB No. 1545-0092. Print or type. 1 . Employer identification ...

What do I do with the Payment Voucher? - Intuit Form 1040-V: Payment Voucher (not to be confused with 1040-ES: Estimated Tax Voucher) is an optional IRS form that you include with your check or money order when you mail your tax payment.. Although the IRS will gladly accept your payment without the 1040-V, including it enables the IRS to process your payment more efficiently.

Forms and Publications (PDF) - IRS tax forms Payment Voucher 2021 12/14/2021 Form 1041-T: Allocation of Estimated Tax Payments to Beneficiaries 2021 11/12/2021 Form 1041-V: Payment Voucher 2021 11/12/2021 Form 1098-MA: Mortgage Assistance Payments 0919 10/02/2019 Form 1099-G: Certain Government Payments (Info Copy Only) ...

PDF Sample Tax Payment Coupon - Michigan Sample Tax Payment Coupon - Michigan

PDF 2021 Payment Coupon (IL-501) and Instructions Most taxpayers who use payment coupons are considered monthly payers. Monthly payers must pay by the 15th day of each month for amounts withheld the preceding month. You may pay more frequently using one of our electronic methods or preprinted payment coupons. Do not use your return, Form IL-941, to pay more frequently.

PDF 2021 Form 1040-V - IRS tax forms Detach Here and Mail With Your Payment and Return Form 1040-V Department of the Treasury Internal Revenue Service (99) Payment Voucher Do not staple or attach this voucher to your payment or return. Go to for payment options and information. OMB No. 1545-0074 2020 Print or type 1 Your social security number (SSN)

Post a Comment for "39 payment coupon for irs"